Starting or operating a business in Dubai requires understanding various regulatory requirements and compliance obligations, including obtaining and verifying your Tax Registration Number (TRN).

This article will provide an overview of everything you need to know about Tax Registration Number verification in Dubai and its significance for businesses operating in the region. We’ll also look at different verification methods and the required documents for the TRN application. So, let’s get started and ensure your business complies with all local laws.

What is a TRN in Dubai?

Source: Pexels

TRN Verification Dubai: A Step-by-Step Guide

Verifying your Tax Registration Number (TRN) is an essential process for businesses and individuals to ensure compliance with the UAE’s tax regulations.

Please note that this tool is accessible to the public, not just TRN-holders.

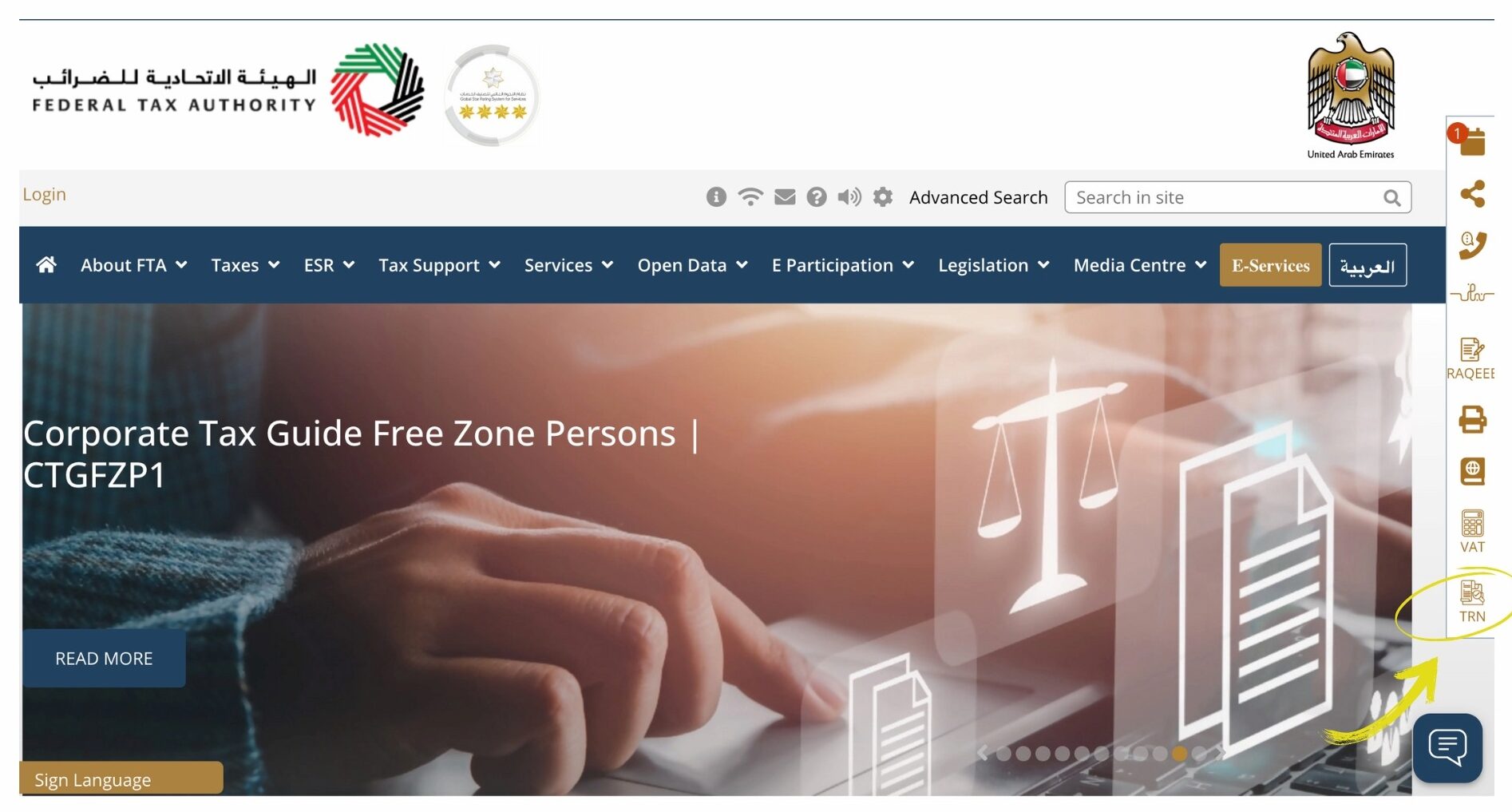

1. Navigate to the FTA Homepage: Follow this link to visit the FTA homepage.

2. Select the TRN Tab: On the FTA homepage, locate and click on the ‘TRN’ tab.

Source: FTA

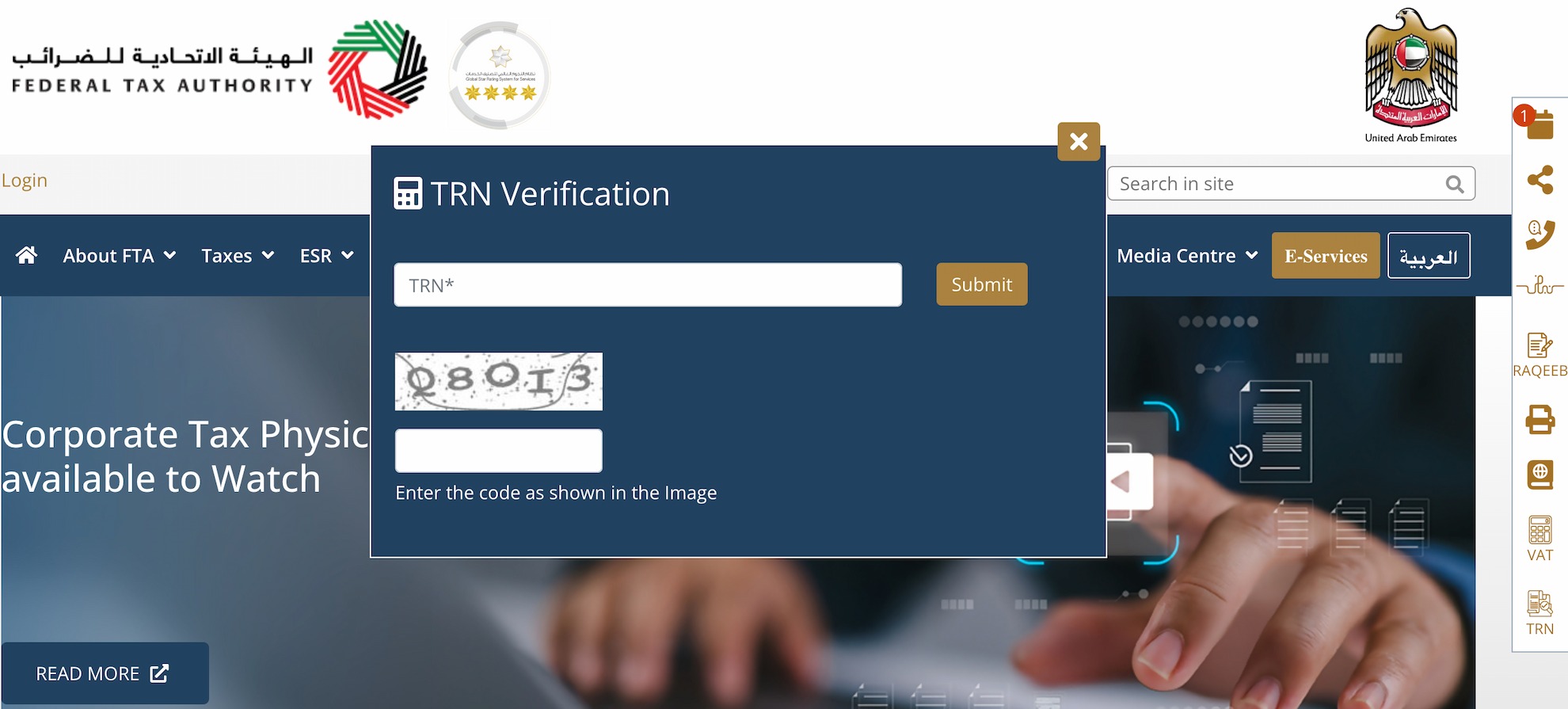

3. Type in the TRN: Input the TRN and the Captcha code into the respective fields. Then, press the ‘Search’ button to proceed.

Source: FTA

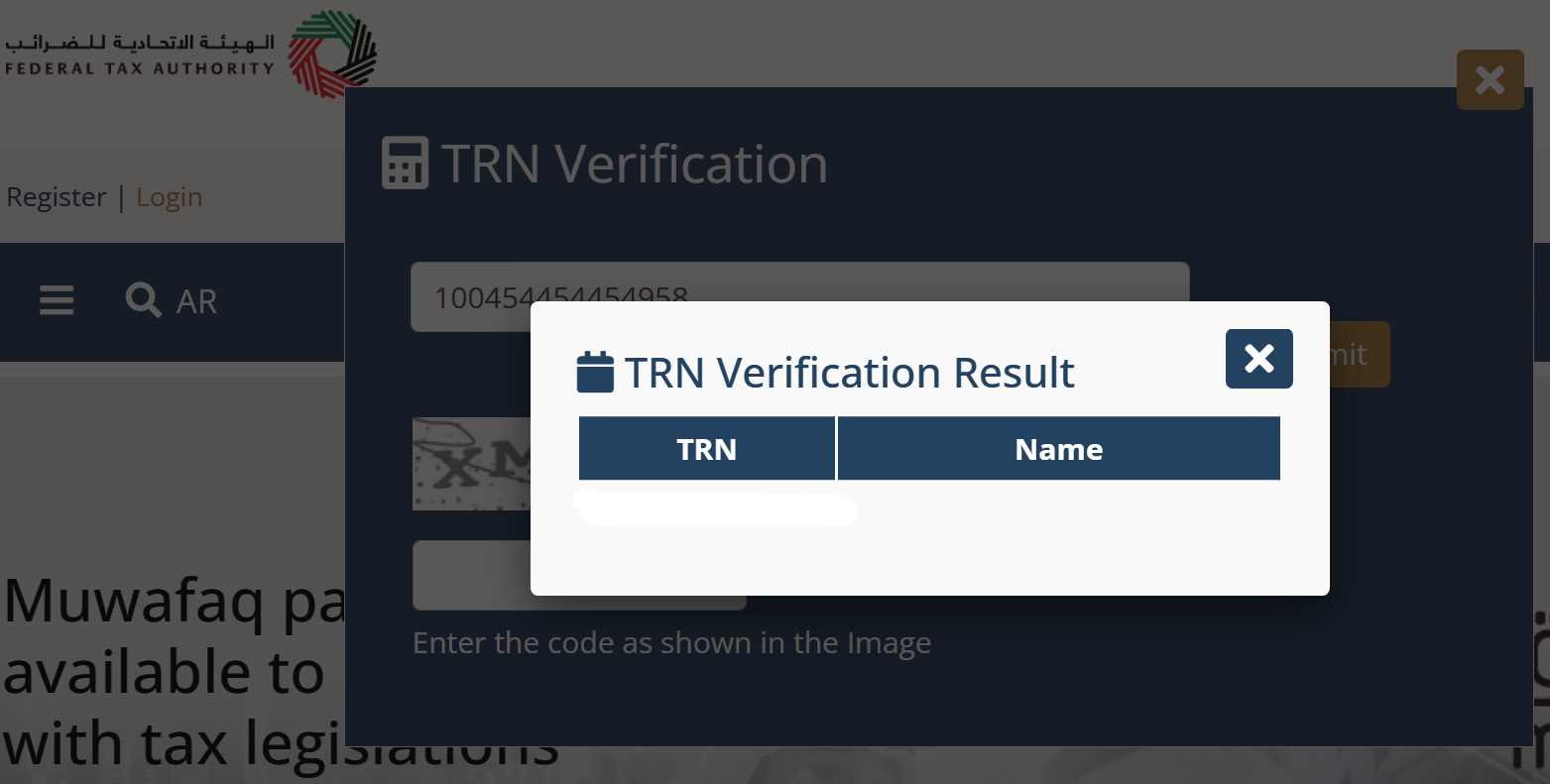

4. Receive TRN Verification: If a business or individual is registered with the TRN you entered, it will show the name and valid TRN side-by-side.

Source: FTA

How to Apply for Your Business TRN

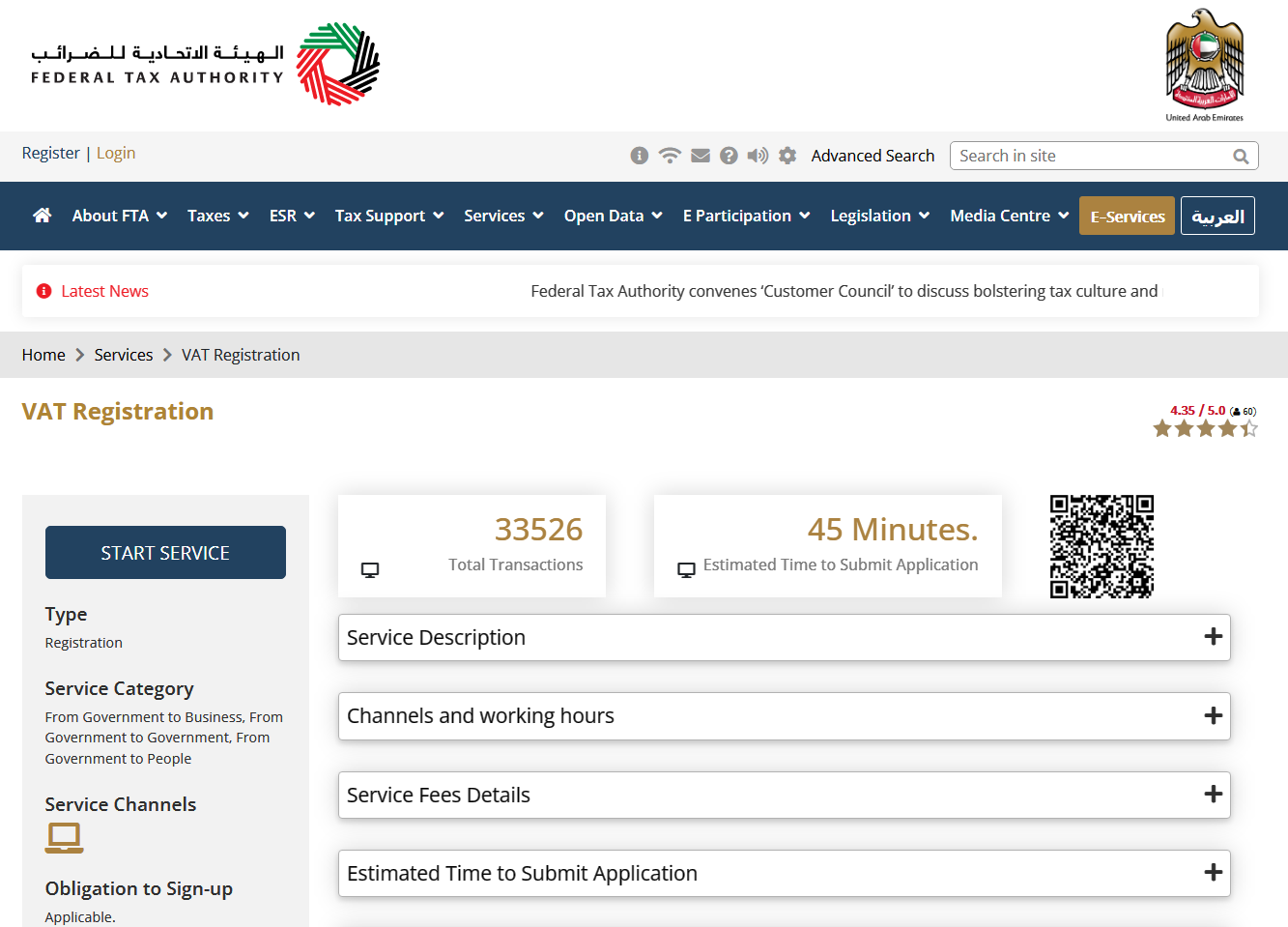

The Federal Tax Authority (FTA) allows you to apply for your business TRN online via e-services free of charge. The entire application process may take approximately 45 minutes, and the FTA takes about 20 business days to process a completed TRN application. However, if the agency needs additional information, it can take up to 60 days for the applicant to get an official response. To avoid this delay, you should provide all required documents and ensure your applications are complete upon submission. Once approved by FTA, you will receive your Tax Registration Number (TRN) in writing.

Alternatively, you can visit the FTA’s office with all the necessary documents and fill out an application form. FTA’s physical service centre in Dubai is located at the Central Park Business Towers – DIFC.

1. Visit the FTA Website: Follow this link to VAT Registration on the FTA website.

Source: FTA

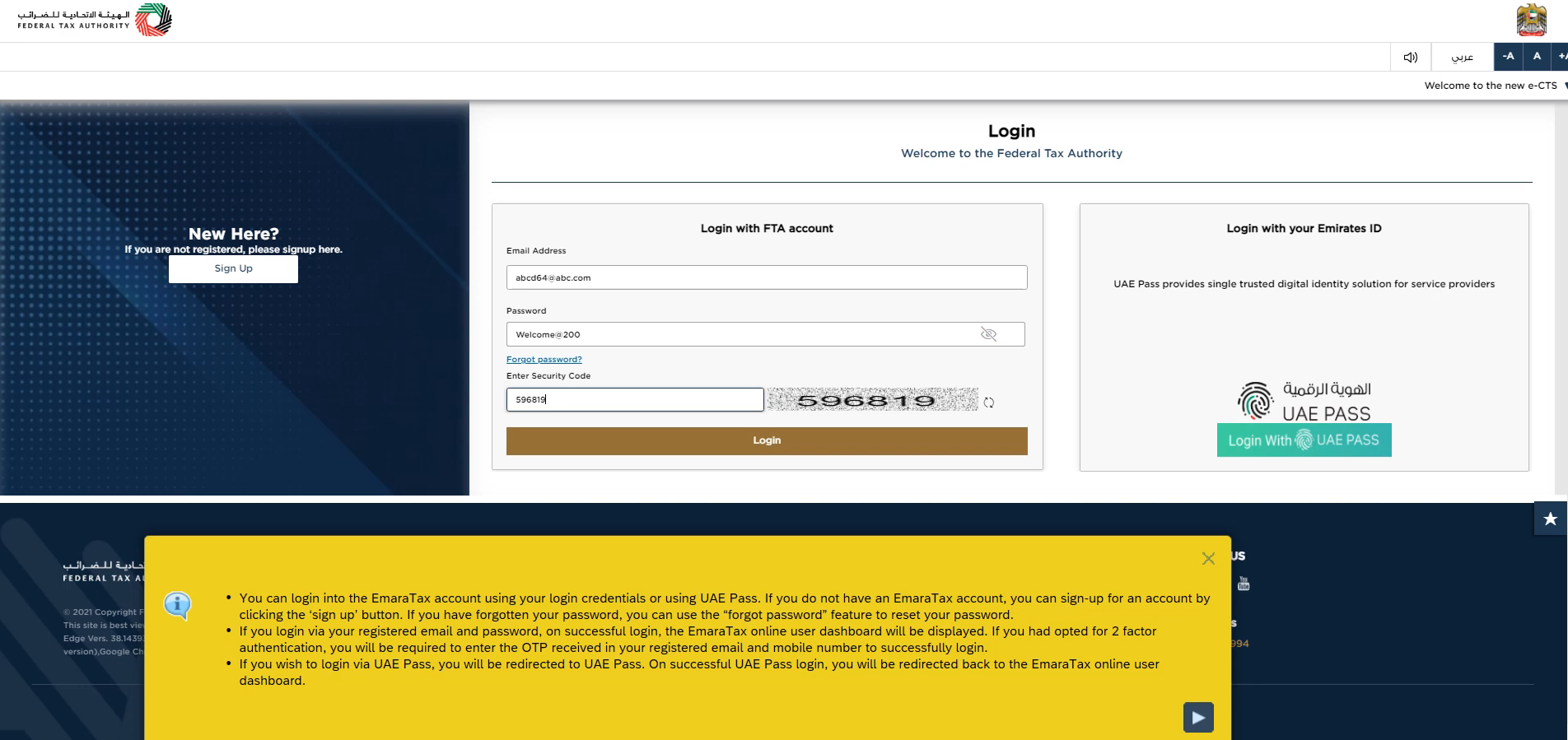

2. Register for an Account or Login: Begin by clicking ‘Start service’ and then either login or click on the ‘Sign Up’ button if you don’t have an EmaraTax Account, where you’ll need to provide an email address and set up a password.

Source: FTA

3. Create a New Taxable Person Profile: Once logged in, you’ll see the EmaraTax dashboard. Click on the option to ‘Create New Taxable Person Profile’. Enter all required details such as business activities, financial information, and contact details.

4. Access the Taxable Person Account: Once your taxable person profile is created, click on ‘View’ to go to your Taxable Person Account. This page will show all your tax-related information and status.

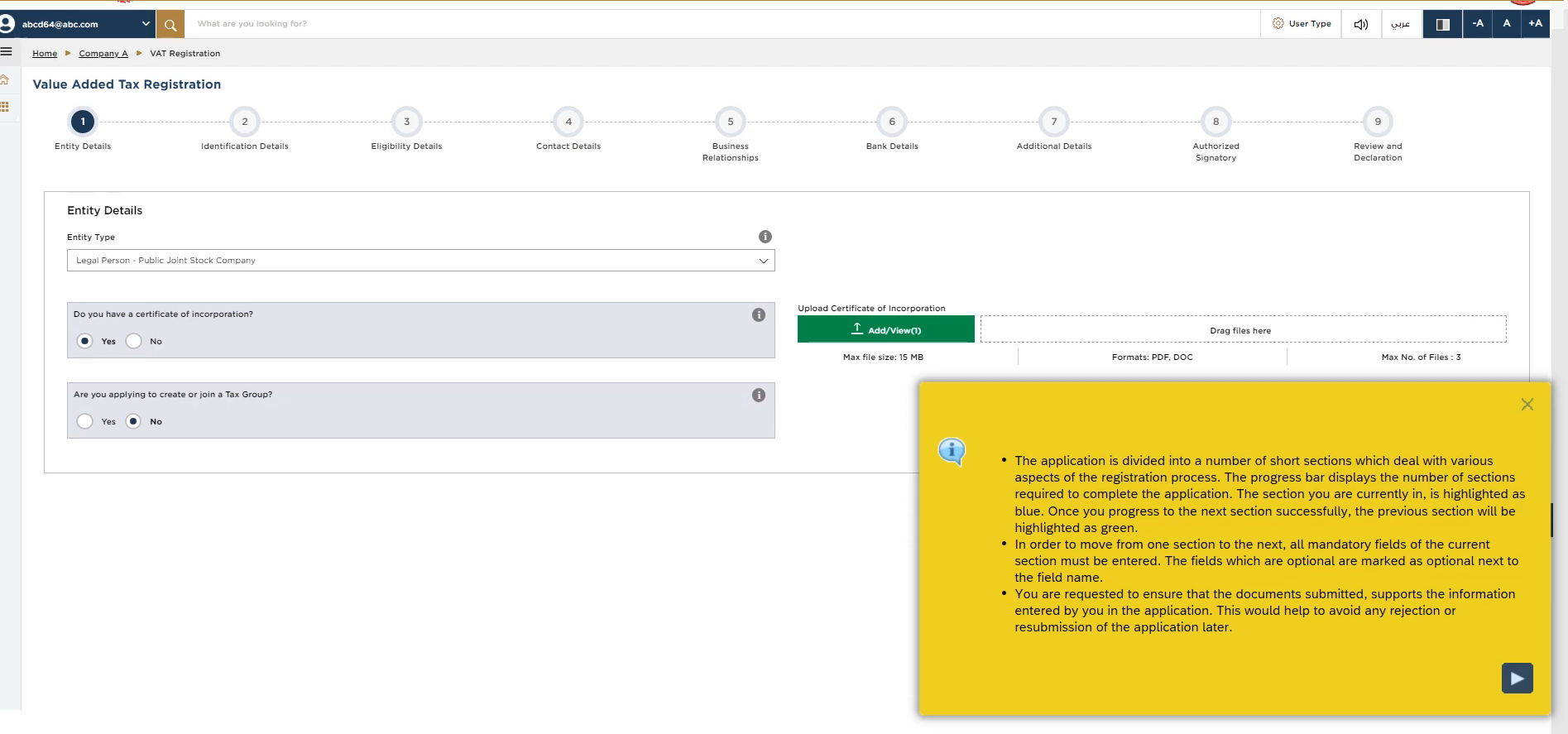

5. Register for VAT: Within the Taxable Person Account, locate and click on ‘Register’ under the ‘Value Added Tax’ section. Begin by inputting your entity type and uploading your certificate of incorporation.

Source: FTA

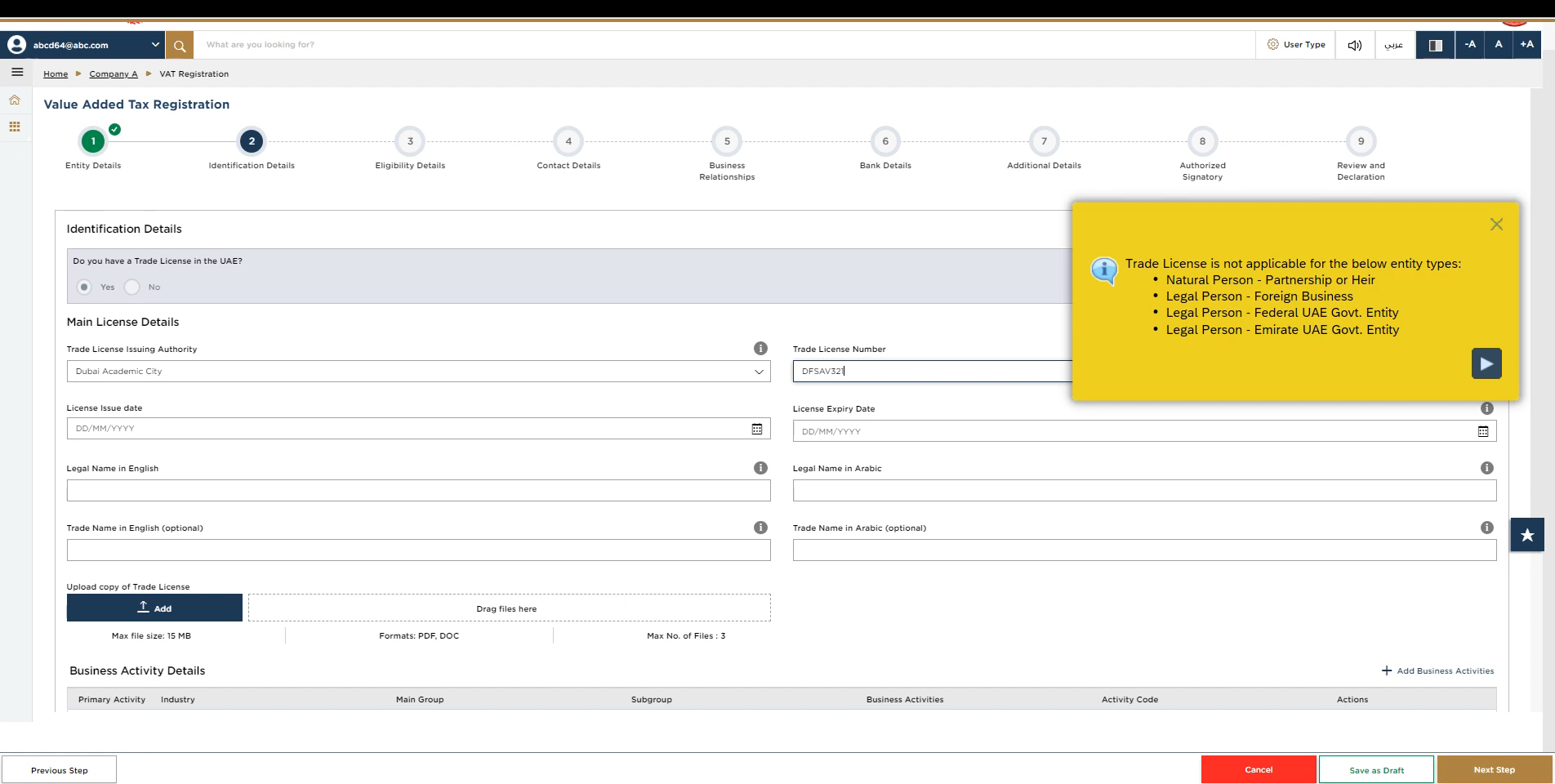

6. Enter Licence Details: The following page, titled “Identification Details” will let you input your commercial licence information. Follow this by entering your business activity, ownership information and branch contact information. The system will guide you through several steps requiring you to enter specific details about your business, including your financial transactions and the applicability of VAT.

Source: FTA

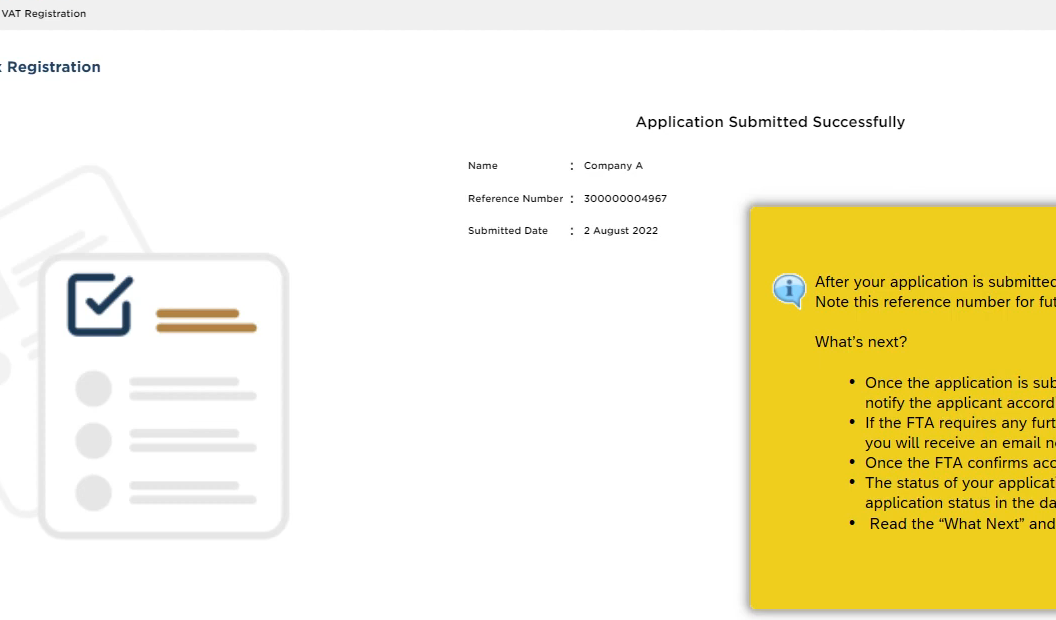

7. Receive Application Confirmation: Once you upload all of the required documents and submit the application, the application session will end with a confirmation and reference number.

Source: FTA

Required Documents for Your TRN Application

Now let’s quickly review the documents you need when applying for a TRN in Dubai.

The FTA requires that you provide the following documents when applying for a TRN:

- Valid commercial licence or trade licence that allows your business to legally operate in the UAE

- Copy of passports or Emirates ID for all the signatories, business contacts, managers, and partners

- Authenticated bank account details from the bank

Supporting Document for TRN Verification Dubai

In addition, you may also need to provide additional documents, depending on your business type and activities. These may include:

- Audit reports or financial statements

- Tax-calculation sheets in the prescribed format

- Declaration of monthly turnover

- Miscellaneous supporting documents, such as tenancy agreements, partnership deeds, invoices and so on.

- Customs documents

- Company Memorandum & Articles of Association (M&A)

- Authorisation and Power of Attorney documents, in applicable cases

- Affiliation documents with any clubs, societies, charities, or social organisations

The 4 Main Benefits of Voluntary VAT Registration in Dubai

Registering for VAT and obtaining a Tax Registration Number (TRN) in Dubai can provide significant advantages for businesses, even if they do not meet the mandatory threshold for VAT registration. Although voluntary registration means your business will need to charge a standard 5% VAT on taxable goods and services, it also allows you to reclaim VAT on your business-related expenses. This dual aspect of the VAT system can balance out and provide operational and financial benefits. Here are several reasons why voluntary registration might be beneficial:

1. Enhanced Business Operations

- Compliance and Invoicing: With a TRN, your business can issue VAT-compliant invoices, adding 5% VAT to the sale price of goods and services, which is essential for maintaining transparency with your customers. This setup also simplifies the process of filing VAT returns and staying compliant with local tax regulations, thereby avoiding potential penalties and fines.

- Input Tax Credits: By charging VAT on sales and claiming back VAT on your purchases, you can manage and often reduce the net amount of VAT payable to the government. This can significantly enhance cash flow and reduce overall tax liability, enabling more capital to be reinvested into growing your business operations.

2. Increased Credibility and Trust

- Boosting Reputation: Having a TRN demonstrates that your business adheres to the UAE’s tax laws and operates legally. This compliance enhances your business’s reputation and credibility, fostering trust among current customers and attracting new ones.

- Protection Against Fraud: In a market where fraudulent activities can occur, possessing a valid TRN helps prove your business’s legitimacy. It shows that your business collects and remits VAT appropriately, distinguishing you from entities that might engage in unethical practices.

3. Streamlined Interactions with Other Businesses

- Business Relationships: A TRN is often required when engaging in transactions with other registered businesses, such as suppliers and corporate clients. It facilitates smoother transactions and is sometimes a prerequisite for conducting business in certain industries.

- Customer Assurance: Customers increasingly look to verify TRNs to confirm they are dealing with reputable businesses. A valid TRN reassures customers about the legitimacy of transactions, particularly in scenarios where VAT refunds or credits are involved.

4. Access to Government Services

- Ease of Access: A valid TRN simplifies the use of government portals and services related to VAT, such as online filings and payments. Keeping your TRN up to date ensures uninterrupted access to these services, essential for efficient business management.

While mandatory VAT registration is linked to specific turnover thresholds, voluntary registration can strategically benefit businesses aiming for robust growth and enhanced credibility in Dubai’s competitive market. By securing a TRN, businesses position themselves as compliant, reliable partners in the eyes of the government, business associates, and customers alike, fostering a healthier business environment.

VAT Rate in Dubai

The standard VAT rate in Dubai (UAE) is 5%. This rate applies to most goods and services, although there are exceptions, such as zero-rated and exempt supplies. Zero-rated items include specific healthcare services, educational services, and international transportation of goods and passengers, among others. Exemptions are granted to certain financial services, residential properties, and local passenger transport. These exceptions ensure that essential services remain affordable and accessible while maintaining the broad applicability of VAT to other sectors.

How to Spot and Report a Fake TRN

A TRN is essential for business operations within the UAE, especially in transactions involving VAT. Verifying the TRN of vendors is a crucial step in ensuring that your business dealings are legitimate and that purchases are compliant with tax regulations. Identifying and reporting fake TRN numbers is crucial to avoid legal penalties and ensure business integrity. Here’s how you can spot and report a fake TRN.

1. Verify the TRN Format

- Check the Format: All TRN numbers must follow the format 100-XXXX-XXXX-XXXX and contain 15 digits. The number should always start with ‘100’.

2. Use Dubai’s TRN Verification Service

- Online Verification: Before proceeding with any transactions, verify the TRN through Dubai’s online TRN verification service to ensure its authenticity (as described in detail above).

3. Report Suspicious TRNs

- Contact the FTA: If you suspect a TRN is fake, report it immediately to the Federal Tax Authority (FTA) by calling their hotline at 800 82923, available Monday through Saturday from 7:30 a.m. to 10 p.m.

- Fill Out an Online Form: Alternatively, report the issue via the FTA’s online contact form at FTA Contact Form. This helps the authority to investigate and address the fraudulent activity.

Fake or incorrect TRNs can result in severe business penalties, including fines, so ensuring you’re working with legitimate entities is crucial.

Source: Pexels

Setup Your Business in Dubai and Secure Your TRN with DUQE

Dubai is a vibrant business hub, and obtaining a TRN is crucial for businesses to operate legally and comply with the VAT regulations. Companies risk facing penalties and fines without a TRN, which can significantly impact their finances. A TRN can also enhance your business’s credibility, reputation, and financial management.

If you’re planning to set up a business in Dubai, it’s tremendously helpful to partner with a reliable and experienced business setup service provider. At DUQE, we offer comprehensive business setup solutions that cater to the specific needs of businesses. From obtaining a TRN to obtaining a Commercial Licence, we can assist you in navigating the regulatory landscape and help you set up your business in Dubai seamlessly.

Don’t navigate the complex regulatory landscape alone. Partner with DUQE, and take the first step towards a successful business setup in Dubai. Contact us today to discuss how we can support your business goals, or visit our website for more information on our business setup services.

FAQ’s

How Many Digits are in a TRN?

A TRN Number contains 15 digits, formatted as 100-XXXX-XXXX-XXXX.

Is Applying for a TRN the Same as Registering for VAT?

Yes, applying for a TRN is essentially the same as registering for VAT in the UAE. When you register for VAT, you are assigned a TRN by the Federal Tax Authority, which you must use in all VAT-related transactions. This TRN acts as your official tax identification for your business under the UAE’s VAT system.

Can You Have a TRN Without Registering for VAT in the UAE?

Do I Include the TRN in VAT Returns that I File with FTA?

Yes, you should include the TRN in the VAT returns that you file with the Federal Tax Authority (FTA). The TRN serves as your unique identifier in all VAT-related documents and communications, ensuring that your tax transactions are accurately recorded and processed.

Is a TRN The Same as a Commercial Licence or an Emirates ID?

No, a TRN is not the same as a Commercial Licence or Emirates ID. A Commercial Licence is a legal document issued by the Dubai Department of Economic Development (DED), which authorises a business to operate within the city’s boundaries. It includes information such as the business name, activities and owner details; it’s mandatory for any business wishing to legally operate in Dubai and cannot be substituted with a TRN. An Emirates ID is another essential requirement for all UAE residents: it contains biometric information, as well as personal details such as name, photo and date of birth. Unlike a TRN, businesses are not obliged to have an Emirates ID to register their business.

Can I Verify a TRN That Isn’t Mine?

Why Do I Need to Verify My TRN After Receiving it From the FTA?

When applying for a TRN or tax verification number, the Federal Tax Authority (FTA) will check the provided information to confirm its accuracy and completeness. After processing your application, you’ll receive your Tax Registration Number, which you must use in all VAT-related transactions under UAE VAT laws. However, it’s important to remember that acquiring a TRN isn’t enough; verifying it regularly is necessary to remain compliant with regulations.