Living and working in Dubai brings unique perks and potential setbacks, such as unexpected job loss. Fortunately, the UAE has a compulsory Involuntary Loss of Employment (ILOE) Insurance Scheme that provides a financial backup if you’re out of work through no fault of your own, helping you manage financially while you look for another job.

In this article, we’ll guide you through the basics of ILOE insurance, including the scope of coverage and payouts, how to subscribe, the costs involved, and how to make a claim. So, if you’re working in Dubai or planning to, read through this guide to help you understand ILOE insurance and the coverage it provides you.

What is ILOE Insurance in The UAE?

Involuntary Loss of Employment (ILOE) Insurance is a scheme the UAE Government has introduced to give temporary financial assistance to employees who have become unemployed for reasons they couldn’t control, such as being made redundant. This scheme doesn’t cover job losses due to disciplinary action or resignation.

ILOE insurance provides a monthly payment for up to three months, which may equal up to 60% of the average base salary calculated from the six months preceding unemployment. To qualify for this benefit, individuals must have paid into the insurance scheme regularly for at least 12 consecutive months.

Subscribing to the ILOE insurance scheme is mandatory for all private and federal government sector employees in the UAE, ensuring all eligible employees have access to a financial safety net.

How to Apply for ILOE Insurance

Registering for the compulsory ILOE (Involuntary Loss of Employment) insurance in the UAE involves several key steps in accordance with Federal Decree-Law No. 13 of 2022. Follow the steps below to subscribe for ILOE insurance:

1. Check Eligibility:

Begin by confirming that you are not within the groups excluded from coverage such as retirees, business owners, investors, temporary contract workers, domestic employees, or individuals under 18.

2. Select Your Insurance Tier:

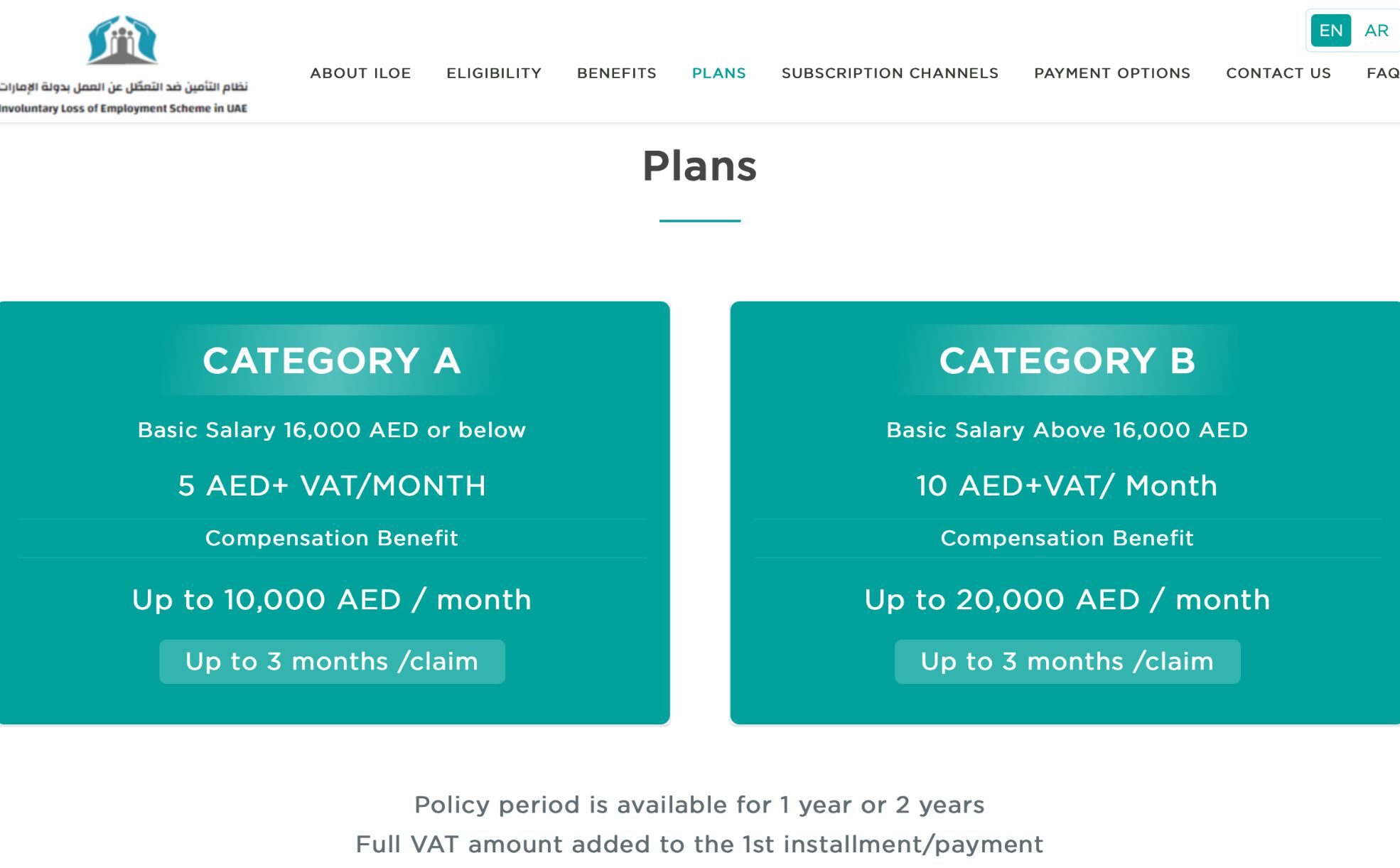

- Category A: For those earning up to AED 16,000, with a monthly premium of AED 5 plus VAT.

- Category B: For those earning more than AED 16,000, with a premium of AED 10 plus VAT.

Note: Additional benefits might be available through negotiation as outlined in Article 11 of Cabinet Decision No. 97/2022.

3. Enrolment Options:

- Direct Enrolment: Access the ILOE portal or its mobile app to subscribe without additional fees. You will need your Emirates ID and contact details to complete the enrolment steps.

- Through Service Providers: For additional fees, you can also subscribe through various approved providers (detailed below).

4. Premium Payment:

Decide on the frequency of your premium payments—options include monthly, quarterly, semi-annual, or annual. Payments can be made via the ILOE portal, its mobile app, or through any authorised service centre.

5. Certificate of Insurance:

After registering, download your Certificate of Insurance from the ILOE portal or app, which will serve as proof of your insurance coverage.

6. Maintain Your Subscription:

To continue eligibility for benefits, keep up with your premium payments as per your selected schedule and ensure your employment details are current.

For a full rundown on payment terms and more details, you should consult the official ILOE payment guidelines.

Where Can I Subscribe to ILOE Insurance in the UAE?

The ILOE insurance scheme, initiated on January 1, 2023, offers a range of subscription and payment options to suit different financial situations and preferences. You can pay your premiums monthly, quarterly, or semi-annually, or even make an annual or full payment.

1. ILOE Portal/App:

To avoid any hidden fees, you can make your payments through the ILOE portal or the ILOE mobile app (download here for Apple and here for Google Play), which is managed by Dubai Insurance. You can also make payments in person or directly at Dubai Insurance’s authorised service centres or contact their official call centre.

2. Deduction From Wages:

Many employers provide the convenience of deducting insurance premiums directly from your wages, which can be arranged through your employer’s human resources department.

3. Other Service Providers:

Payments can also be made through exchange centres, business centres, via SMS and telecommunication bills, kiosks, bank apps, and ATMs.

4. Private Entities:

Lastly, private entities such as Al Ansari Exchange, MBME Pay, uPay, Botim, and C3Pay have partnered with Dubai Insurance to offer the service of signing up for ILOE, however additional service charges may apply.

ILOE Insurance Coverage and Eligibility

This guide outlines the scope and specifics of what ILOE insurance covers, along with the eligibility requirements.

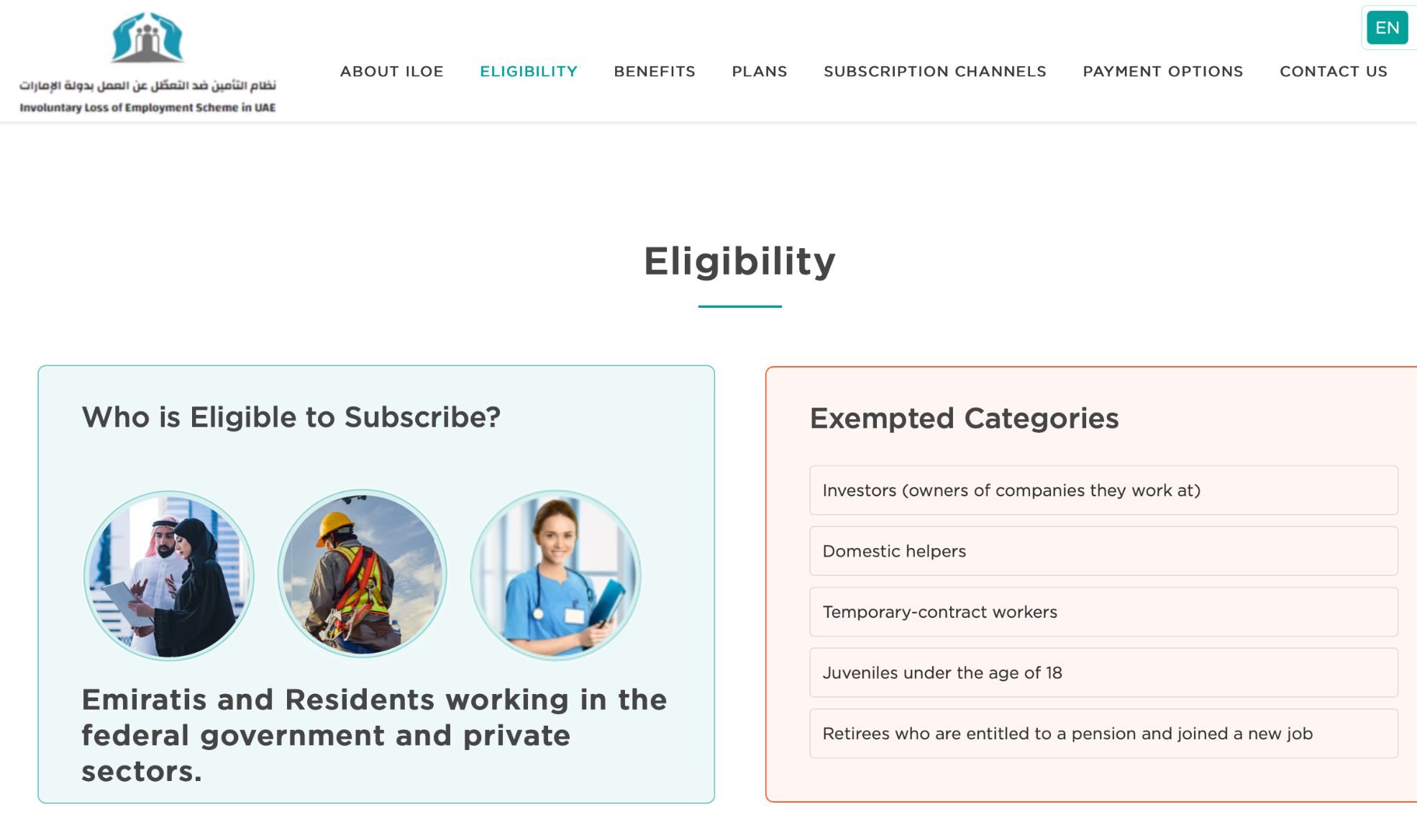

Eligibility

- Who is Eligible? To be eligible for ILOE insurance, job losses must not be instigated by the employee. Additionally, the policyholders must keep up with premium payments for a minimum of twelve months to be eligible to lodge a claim. Beneficiaries must also be legal residents of the UAE at the time they claim the benefits

- Who is Not Eligible? ILOE insurance doesn’t provide coverage for individuals on temporary contracts, investors, domestic workers, minors, retirees, and those dismissed for disciplinary reasons. Losses due to external disruptions like war or natural disasters are also not covered.

Coverage Details and Duration

- Salary Compensation: Eligible employees may receive up to 60% of their average basic salary for the six months prior to losing their job.

- Duration: The insurance provides benefits for up to three months per incident.

- Overall Benefit Limitation: Total benefits are capped at 12 months throughout the insured’s career in the UAE to maintain the insurance fund’s viability. Coverage ceases upon reaching the total benefit limit or the death of the insured.

Categorisation of Benefits

- Lower Salary Band (Category A): For those earning up to AED 16,000, with a monthly premium of AED 5 plus VAT. Benefits are capped at AED 10,000 per month.

- Higher Salary Band (Category B): For those earning more than AED 16,000, with a premium of AED 10 plus VAT. The benefits cap increases to AED 20,000 per month. The total VAT amount is added to the first instalment/payment.

How to Find Your ILOE Certificate

Acquiring your ILOE certificate can be easily done using digital tools if you are already enrolled in the insurance program but haven’t received your certificate yet. Here’s how you can access your Certificate of Insurance:

1. Visit the ILOE Site:

- Portal: Visit the ILOE online portal.

- Mobile App: Alternatively, use the ILOE mobile application.

2. Sector Selection:

Choose your specific sector from the provided options to ensure you receive services that cater specifically to your industry or personal needs.

3. Identity Verification:

Enter your Emirates ID and Mobile Number to link to your insurance policy and verify your identity. Request and enter the OTP (one-time password) sent to your mobile.

4. Policy Review and Certificate Download:

- Navigate to ‘View Policy Details’ to check the specifics of your insurance policy.

- Download your ILOE certificate directly from this section.

How to Make a Claim with ILOE Insurance

1. Confirm Your Eligibility:

- Before initiating a claim, ensure that your job loss qualifies under ILOE conditions, which excludes voluntary resignations and dismissals due to misconduct. Investors, business proprietors, domestic employees, individuals engaged on temporary contracts, people under 18 years old, and retirees who receive a pension and have started a new job are also ineligible for the ILOE insurance scheme.

- You must be legally present in the United Arab Emirates.

- Verify that you have been contributing to the scheme for at least 12 consecutive months.

- Claims must be submitted within a 30-day bracket from the date of termination.

2. Gather Required Documentation:

- Proof of Employment and Termination: Collect documents such as your termination letter, which should state the reason for job loss as involuntary.

- Salary Evidence: Prepare the last six months’ salary slips or bank statements to demonstrate your average basic salary.

- Emirates ID: Have your Emirates ID ready for identity verification purposes.

3. Initiate the Claim:

- Visit the ILOE Portal or App: Claims may be made through the ILOE portal, mobile app, ILOE call centre, or any other specified channels by MOHRE in coordination with the Insurance Pool.

- Claim Section: Navigate to the claims section and select the option to initiate a new claim.

- Enter Required Information: Fill out the claim form with accurate details about your employment and the nature of your job loss. Upload the necessary documents that support your claim.

4. Submit the Claim:

- Review all the information and documents to ensure accuracy.

- Submit the claim and take note of the claim reference number provided for future reference.

5. Claim Processing:

- Once submitted, your claim will be processed by the insurance provider.

- The processing time can vary; during this period, you may be contacted for additional information or clarification.

6. Follow Up:

- Keep track of your claim status through the ILOE portal or app.

- If needed, you can contact the customer service for updates or assistance.

7. Receive Your Benefits:

- If your claim is approved, the benefits will be disbursed directly to your bank account as per the policy terms.

- Payment is typically made within 2 weeks after claim approval.

8. Address Discrepancies:

- In case of any discrepancies or if your claim is denied, review the reasons provided and consider whether to appeal the decision.

- Consult with ILOE support or a legal advisor if necessary to understand further steps or rectification measures.

ILOE Insurance Fines

As discussed, enrolment in the ILOE insurance scheme is compulsory for all private and federal government sector employees in the UAE. The fines for non-compliance with the ILOE insurance scheme are detailed below:

- Failure to Enrol: Employees who did not enrol in the scheme by October 1 2023, or within four months of starting work in the country after January 1, 2023, will incur a fine of AED 400.

- Delayed Premium Payments: A penalty of AED 200 is levied if premiums are unpaid three months past the due date, leading to the cancellation of the insurance certificate.

- Collection of Fines: Penalties may be deducted from an employee’s salary via the Wage Protection System, end-of-service benefits, or other approved methods. Workers may also negotiate payment of fines in instalments or request a waiver in specific situations.

- Impact on Work Permits: Failing to settle fines can restrict the issuance of new work permits until all outstanding payments are resolved.

For comprehensive information, refer to the Ministerial Resolution No. 604 of 2022 regarding the Unemployment Insurance Scheme.

Resolving Issues with ILOE Claims

If you encounter problems with your ILOE claim, consider the following steps to address them:

- Collect Relevant Documents: Start by compiling all pertinent documents related to your unemployment situation. This should include your termination letter, any related communication with your employer, and your insurance policy information.

- Submit a Formal Claim: In cases of claim rejections or disputes over the benefit amount, initially file a claim through the official channels provided by your insurance provider, such as the ILOE Portal or ILOE App.

- Request Clarification: If your claim is disputed or denied, contact the insurance provider for detailed clarification. You can contact them via email at claims@iloe.ae or via telephone at 600 599 555.

- File a Formal Complaint: Should the issue persist, submit a formal complaint. This should be directed to the Ministry of Human Resources and Emiratisation.

- Consult a Legal Advisor: For complex issues, such as claims of unfair dismissal or discrimination, it might be wise to seek legal counsel. A lawyer can assess the merits of your case and advise on the appropriate actions to take.

- Initiate Legal Action: As a final measure, if the dispute remains unresolved via internal channels or through the Ministry, consider taking legal action in the UAE courts. Be mindful that this step should be a last resort due to the potential for significant expenses and time commitment.

- Maintain Thorough Records: Keep meticulous records of all interactions and paperwork exchanged during the dispute process. Regular follow-ups and organized documentation are vital for effectively managing and potentially resolving your claim.

Securing Your Future with ILOE Insurance

In these unpredictable times, ILOE insurance is a lifesaver for Emiratis and Dubai residents. It provides a financial cushion, ensuring that you’re not left high and dry if you lose your job. This mandatory safety net protects against unexpected job loss, helping you maintain financial stability during tough times.

To fully benefit from the scheme, keeping up with your payments and knowing the conditions to claim your benefits is essential. You can confidently navigate your professional journey, knowing the ILOE Insurance scheme has your back.

ILOE Insurance FAQs

Who is Exempt from ILOE insurance in the UAE?

While the ILOE scheme is designed to offer financial protection to most employees in the UAE, certain categories of workers are not required to subscribe. These include investors, business owners, domestic workers, temporary contract workers, individuals under 18, and retirees receiving a pension and taking up a new job.

If Your ILOE Insurance is Cancelled, Can You Subscribe Again?

Is ILOE Mandatory in UAE?

Indeed, the ILOE scheme is obligatory for most employees in the UAE, including those in the private sector, the federal government, and free zones. It’s important to remember that the onus is on you, the individual employee, to register and pay the premiums. Non-compliance could result in fines.

How are the Benefits Calculated Under ILOE Insurance?

Benefits are often set at a certain percentage of the employee’s average basic salary. Commonly, this could be up to 60% of the average salary calculated over a specified period, usually the six months leading up to unemployment. However, there are caps on the monthly payouts. For those earning up to AED 16,000, the benefits are capped at AED 10,000 per month, whilst those earning more than AED 16,000 have their benefits capped at AED 20,000 per month.

Which ILOE Insurance Category Should I Apply For If My Income is Variable?

If your salary fluctuates significantly, consider basing your category choice on the most consistently earned amount. This approach can help you avoid under-insurance or overpaying premiums.